RoyaltyRange in Italy

As a result of the recent BEPS recommendations issued by the OECD, changes to the Italian transfer pricing legislation and Patent Box regime implementation in Italy, RoyaltyRange has been providing data and services to a significant number of Italian legal and consulting firms.

The most common purposes for the use of RoyaltyRange royalty rates data include Transfer Pricing, Patent Box and Valuation analyses. For more information about RoyaltyRange database and services please see our database presentation

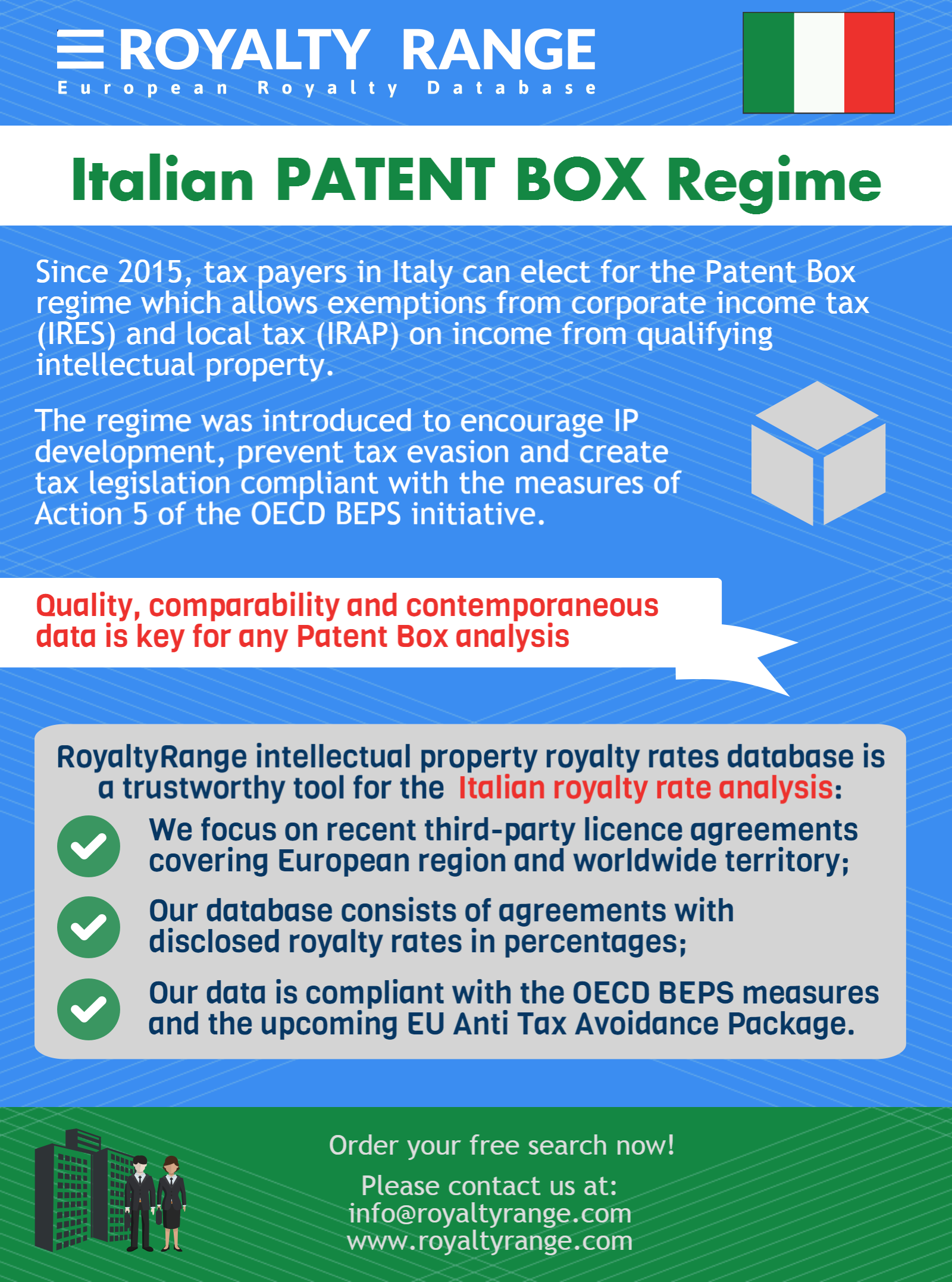

Italian Patent Box Regime

Since 2015, tax payers in Italy can elect for the Patent Box regime which allows exemptions from corporate income tax (IRES) and local tax (IRAP) on income from qualifying intellectual property.

The regime was introduced to encourage IP development, prevent tax evasion and create tax legislation compliant with the measures of Action 5 of the OECD BEPS initiative.

Italian Royalty Rate Analysis

As a general rule, quality, comparability and contemporaneous data is key for any Patent Box analysis. With regards to this, the RoyaltyRange intellectual property royalty rates database is a trustworthy tool for the Italian royalty rate analysis: